It’s no secret that personalization holds the key to successful email marketing.

In fact, 62 percent of consumers respond positively to emails with personalized content, while 76 percent feel frustrated when they don’t receive personalized interactions.

But I’m going to let you in on a dirty secret:

Not all personalization is equally valuable.

Sure, it might be kind of interesting to segment your audience by their dog’s inside leg measurement or their uncle’s favorite Rihanna song.

However, that sort of personalization probably won’t translate to more email opens, click-throughs, and sales.

On the flip side, every ecommerce brand definitely wants to segment based on customer buying behavior. That way, they can share messaging and offers tailored to frequent buyers, high spenders, and recent purchasers.

That’s where RFM analysis comes in.

In this article, I’m going to explain what RFM analysis is all about, show you how to calculate it, and demonstrate the types of messaging you can share once you’ve crunched the numbers yourself.

Table of Contents

What Is an RFM Analysis?

A Recency, Frequency, and Monetary analysis is a way to segment customers based on how recently they’ve purchased, how frequently they buy from you, and how much money they spend in the process.

There are various iterations of RFM modeling. For instance, the “monetary” element can be defined in a couple different ways, such as

- The customer’s total lifetime spending to date

- How much they spent on their latest transaction

- Their average order value (AOV)

Each of those metrics is a little different, but they all tell you something about the customer’s spending habits.

Similarly, “recency” could refer to the length of time between purchases, engagements, click-throughs, or something else entirely.

There’s no single, correct approach here. Rather, it’s up to you to define the RFM metrics that make the most sense for your brand, audience, and marketing goals.

Whatever you come up with, you’ll use your metrics to award each customer a “score” that groups them together with other people who share similar shopping habits.

That way, you can target them with messaging that aligns with their behaviors and preferences, making it more likely they’ll engage and (hopefully) convert.

How to Calculate RFM Scores

The first step to calculating RFM scores for your audience is to define each individual metric.

As I’ve already noted, there are a few ways to approach this, but I’ll use the following definitions for the purposes of this article:

- Recency: The length of time since the customer’s latest purchase.

- Frequency: The customer’s average time between purchases.

- Monetary: The customer’s average purchase value.

Now, you need to dig into your data. Pull up (at least) the last 12 months of transactions so you can put benchmarks on each of your RFM metrics.

For instance, let’s say your average customer buys once per quarter and your product has a lifecycle of between two and four months. In that case, your frequency scores might look like this:

- Customers who buy once every four months, on average, score a 1

- Customers who buy once every three months, on average, score a 2

- Customers who buy once every two months, on average, score a 3

In other words: people who buy most frequently earn higher scores, because they’re more valuable to your business. Simple, right?

Moving on, we’ll say repeat purchasers tend to buy from our imaginary ecommerce store once every 45 days. We could use that tidbit of data to summon up the following recency scores:

- Customers who bought within 46+ days score a 1

- Customers who bought within 45 days score a 2

- Customers who bought within 30 days score a 3

And finally, imagine our store’s average basket is $75. Let’s use that information to segment our audience based on monetary value, as follows:

- Customers who spend <$75 per transaction score a 1

- Customers who spend $75 – $100 per transaction score a 2

- Customers who spend $101+ per transaction score a 3

For simplicity’s sake, we’ll add all that information to an RFM chart:

| Recency | Frequency | Monetary |

| 1: Purchased within 46+ days | 1: Bought once per four months | 1: AOV of $75 |

| 2: Purchased within 45 days | 2: Bought once per three months | 2: AOV of $75 – $100 |

| 3: Purchased within 30 days | 3: Bought once per two months | 3: AOV of $101+ |

What Does RFM Modeling Tell Us?

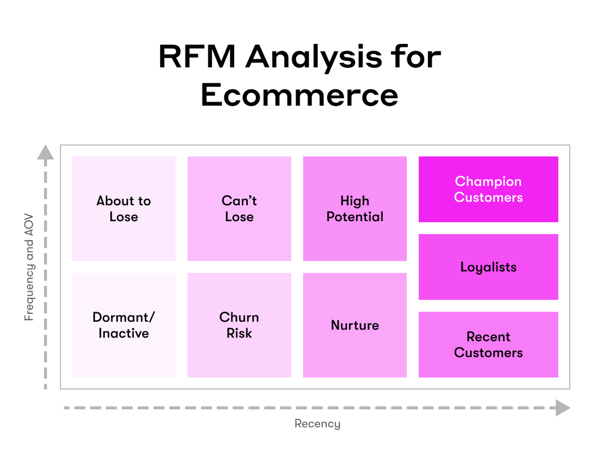

Once you’ve assigned values to each of your RFM metrics, you can segment your audience based on their RFM scores.

As you’ve probably realized by now, your most valuable customers will score threes across the board, while the least valuable will score 111. Triple-twos fall somewhere in between.

But RFM scoring is a little more nuanced than that.

Clearly, not every customer is going to score the same number three times. Along with all those 111s, 222s, and 333s, you’ll find all manner of variants.

For instance, our make-believe ecommerce site might have a customer who buys once every two months on average. And they like to buy in bulk, dropping an average of $150 per transaction. Yet they haven’t placed an order for the last three months, so they score 133—indicating they’re a lapsed, high-value customer.

If you laid your shoppers out on a grid, it might look a little something like this:

Now, let’s take a look at a few more examples of RFM scores and figure out what they tell us about customers within those segments:

1. Consistent Colins (Scores 331, 332)

Who Are They?

These folks aren’t your flashiest spenders; they’re not dropping huge sums each time they visit your site.

But they’re consistent, placing regular orders from your store—and they’ve bought recently, so there’s no indication they’re at risk of lapsing. There’s a lot to like about Consistent Colin.

How to Target Them

There are a couple ways to go about this.

One approach is to invest all your efforts into transforming Consistent Colins into 333-scoring champion customers. You just need to persuade them to spend a little more with each transaction. To that end, you might hit them with regular upsells and cross-sells—ideally informed by the types of products they love to buy.

Alternatively, you could leverage their loyalty and consistency to turn them into brand advocates. Ask them for reviews; invite them to your loyalty program; offer them an incentive to refer friends and family.

2. High-Rolling Helens (Scores 113, 123, 213, 223)

Who Are They?

High-Rolling Helens are kind of the antithesis of Consistent Colins: they don’t buy super-regularly, and they might not have purchased from you recently. But when they do, they spend a lot.

How to Target Them

Again, it may only take a little gentle coaxing to turn these high-spenders into regular, high-frequency buyers too.

Try sharing regular promotions and personalized product recommendations to encourage them to buy more often. Just don’t go too heavy on the discounting—you don’t want to slash their average order value in the process.

3. Brand-New Billies (Scores 311, 312, 313)

Who Are They?

Brand-New Billies (sorry, I’m starting to regret these names) are shiny, new customers who’ve only placed a single order from you so far. At this point, it’s tough to predict anything about their future behavior, so your task is to nurture them.

How to Target Them

Your first port of call is a welcome email series that explains a little more about your brand, values, and products.

Once you’ve made your introductions, it’s all about turning your one-off buyer into a returning customer. Share reviews and testimonials; point them toward your most popular products; offer a discount or free shipping on their next purchase.

3 Practical Ways to Leverage RFM Modeling in Email Marketing

By this point, you should have a decent understanding of how RFM analysis works and the types of insights it reveals about your audience.

Now, let’s dive into Drip’s email marketing swipe file to look at the sorts of personalized messaging you can share with your newly segmented customers.

1. Target Lapsed Customers With Win-Back Emails

As we already know, lapsed customers are those with a “1” for recency, but a higher score for frequency.

You want to win these customers back before they fall into the hands of one of your competitors—especially if they have a monetary score of 2+.

In other words, you need to launch a customer retention campaign, just like plus-sized fashion brand Torrid.

The campaign started with an eye-catching personalized subject-line that referred to the customer by name:

![]()

It’s also kind of guilt-inducing. I’m certainly not suggesting you adopt this tone in all your communications, but it’s a good choice for a last-ditch win-back email.

Once you’ve persuaded the customer to open your retention email, it’s about giving them a reason to click through and buy. Torrid got it right again by cramming incentives above the fold:

Free shipping is a powerful motivator, with one study revealing online shoppers are twice as likely to respond to it than to a “regular” price promotion.

To make doubly sure, the email also included a 30 percent discount. That’s a lot of reasons to restart your relationship with Torrid.

2. Upsell & Cross-Sell to High-Spending Customers

Upselling is all about persuading customers to buy a higher-value product than one they intended to purchase, while cross-selling involves recommending products that complement their current (or previous) purchase.

Both can encourage high-spending customers to further boost their average order value, while cross-selling can also have a positive impact on purchase frequency.

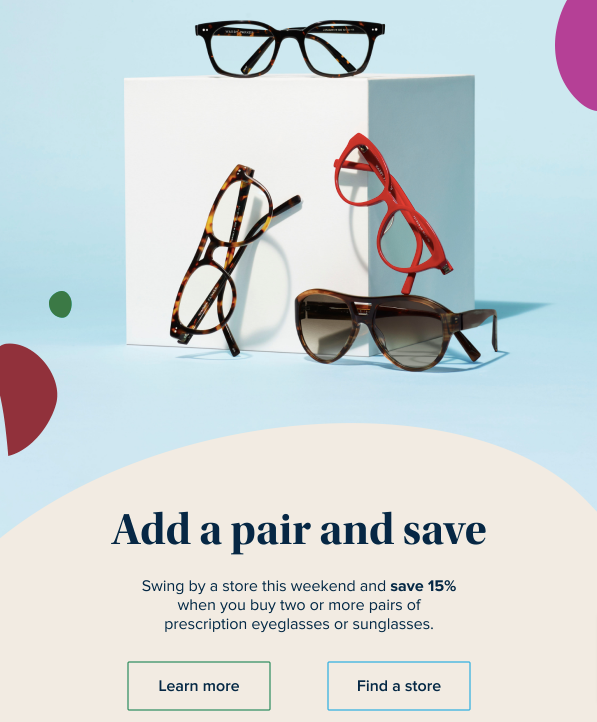

Let’s take a look at an upsell email example from eyewear brand Warby Parker:

This is a pretty simple upsell: rather than buying one product, why not buy two? But Warby Parker intelligently positioned it as a saving by offering a 15 percent discount on orders of 2+ products.

3. Promote Your Loyalty Program to Long-Standing Customers

Loyal customers—those who’ve bought from you repeatedly and consistently over an extended period—are an ecommerce marketer’s dream. According to KPMG:

- 86 percent of these committed buyers will recommend you to their friends and family

- 66 percent will write a glowing online review after a positive customer experience

- 46 percent will stay loyal to your brand, even after a negative experience

So it’s in your best interests to turn long-standing customers into loyal brand advocates by encouraging them to join your loyalty program.

McKinsey & Company research demonstrates the potential value of running a loyalty program. It found that top-performing programs can increase revenue from points-redeeming customers by up to 25 percent a year by boosting their average basket size, purchase frequency, or both.

Mavi Jeans is one retailer that’s well aware of the benefits of maintaining an attractive loyalty program.

The brand regularly uses clear, persuasive messaging to promote the program to existing customers, just like in this example:

One top tip for running a successful loyalty program: keep it simple.

In other words, don’t make loyal customers jump through hoops to unlock rewards. It’s about nudging them to buy slightly more often or spend a little more money on each purchase, not forcing them to dramatically change their behavior.

Mavi gets this right by clearly spelling out the terms of its loyalty program within the email body:

With such an easy-to-understand offer, there’s really no reason for long-standing Mavi customers not to sign up.

Level Up Your Audience Segmentation With Drip

RFM modeling is a simple but effective way to segment your audience based on their buying behaviors.

But it’s far from the only way.

With Drip, you can open up a whole world of dynamic segmentation that updates on the fly, allowing you to target customers in real time.

Want to reach someone who’s just browsed a product page, or clicked through from a specific email campaign, or interacted with your product reviews? Drip can make it happen.

See the power of dynamic segmentation for yourself by signing up for your 14-day free trial today.